Index Card for India

The original Index Card for personal finance was published by Harold Pollack here: Index Card It became quite popular and the author co-wrote a book on it. In a great episode on Freakanmoics Radio, Pollack listed the rules this way. The transcript can be found here (Search for Pollack if you want to skip the initial part on NFL players.)

- Rule No. 1: strive to save 10 to 20 percent of your income.

- Rule No. 2: pay your credit card balance in full every month.

- Rule No. 3: max out your 401(k) and other tax-advantaged savings accounts.

- Rule No. 4: never buy or sell individual stocks and Rule No. 5: buy inexpensive, well-diversified index mutual funds and exchange-traded funds.

- Rule No. 6: make your financial advisor commit to the fiduciary standard.

- Rule No. 7: buy a home when you are financially ready.

- Rule No. 8: insurance. Make sure you’re protected.

- Rule No. 9: do what you can to support the social safety net.

- Rule No. 10: remember the index card.

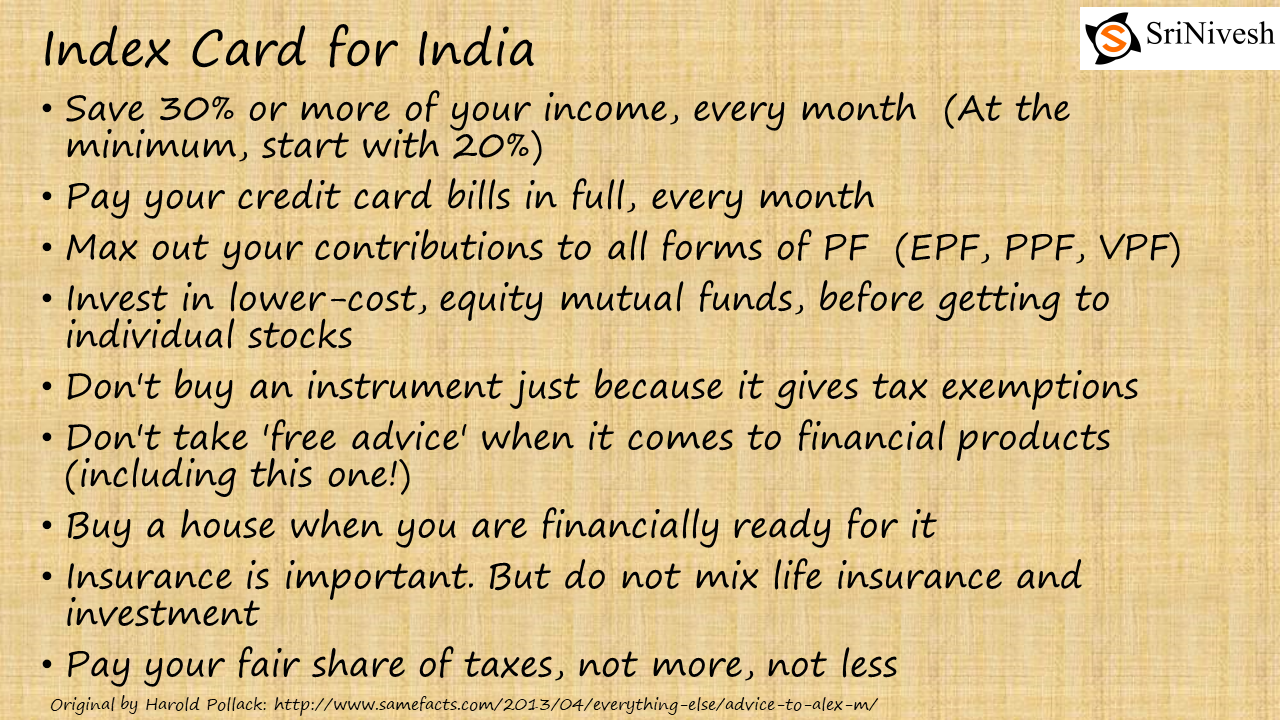

Here is a version of the Index Card, adapted for India.

The above list tries to stay close to the original version. And like the original version, it is self-explanatory to an extent. I plan to add a short explanation for each point in later posts.

- Personal Finance Rule 1 – Save 30% of your income

- Personal Finance Rule 2 – Pay your credit card bills in full

- Personal Finance Rule 3 – Max out all forms of PF

- Personal Finance Rule 4 – Boring is Better

- Personal Finance Rule 5 – Don’t invest to just save tax

- Personal Finance Rule 6 – ‘Free Advice’ is Expensive

- Personal Finance Rule 7 – Buy a house only when financially ready

- Personal Finance Rule 8 – Do not mix Life Insurance and Investment

- Personal Finance Rule 9 – Pay your fair share of taxes, and nothing more

Pingback: Personal Finance Rule 1 - Save 30% of your income

Pingback: Personal Finance Rule 2 - Pay your credit card bills in full

Pingback: Personal Finance Rule 3 - Max out all forms of PF

Pingback: Personal Finance Rule 4 - Boring is Better

Pingback: Rule 5 - Tax Savings is not mandatory | SriNivesh

Pingback: Personal Finance Rule 6 - 'Free Advice' is Expensive | SriNivesh

Pingback: Personal Finance Rule 7 - Buy a house only when financially ready | SriNivesh

Pingback: Personal Finance Rule 9 - Pay your fair share of taxes, and nothing more | SriNivesh