Real Estate Investment Trust (REIT) is a very interesting financial product. A lot of savvy investors in the developed countries use REIT to provide better income than typical bonds. The regulatory structure in India for REIT has existed for a few years. The very first product in this space is being spearheaded by the Embassy Group.

Embassy Office Parks REIT has two sponsors – Embassy real estate group and US-bases Blackstone private equity group. After the formation process is completed, the REIT would own a significant number of commercial real estate. The rent and other income from these properties would accrue to the unitholders of the REIT.

In this post, we look at a brief analysis of the financial parameters and operational structure of the REIT. The analysis concludes that the financial parameters of the REIT look attractive. The operational structure may not protect the interests of the (minority) public unitholders.

Update: At the end of the IPO period, the issue has been oversubscribed by more than 2 times. There has been significant interest from non-institutional and retail investors. The summary above continues to be valid after the REIT lists in a few days. Demand in the secondary market could be volatile in the initial period.

Introduction to REIT

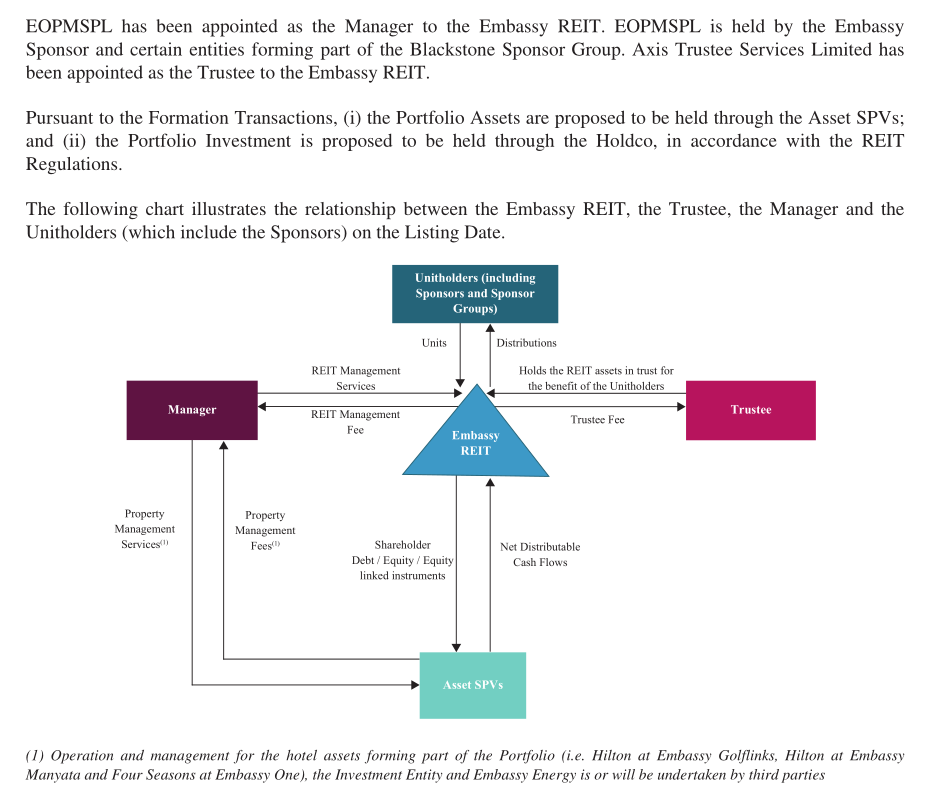

It is easiest to understand REITs by comparing them to mutual funds. REIT is basically a collective investment scheme which pools the funds from investors into real estate. The picture above is from a different country, but captures the essence of REIT structure in India. An additional entity – Sponsor – is defined in India and plays a role similar to the Sponsor in mutual funds. In India, REITs are restricted to invest in commercial, completed real estate properties. They have to distribute at least 90% of the income to unitholders – this is one key difference between debt mutual funds and REITs.

Embassy Office Parks REIT

REIT Structure

The structure of Embassy Parks REIT closely follows the REIT model. It has two sponsors.

- Embassy Property Developments Private Limited is part of the Embassy group and is called the Embassy Sponsor in the offer document

- BRE/ Mauritius Investments is part of the Blackstone group and is called the Blackstone Sponsor (Blackstone is a part owner of one of the biggest properties – Embassy Manyata – that would be part of the REIT)

Embassy Office Parks Management Services Private Limited is the Manager of the REIT and performs a role similar to the mutual fund AMC. Axis Trustee Services Limited is the Trustee. The properties that form part of the REIT are primarily owned by Special Purpose Vehicles, who have varying levels of current ownership. The overall structure of the REIT is given in the Offer Document. (Many of the images are sourced from the Offer Document.)

The Manager in this case is controlled by the Sponsors. The Manager gets compensated from the REIT as well as the asset companies. The Manager has been managing the biggest asset – Embassy Manyata – for many years now and has strong links with the Embassy group.

REIT Property Portfolio

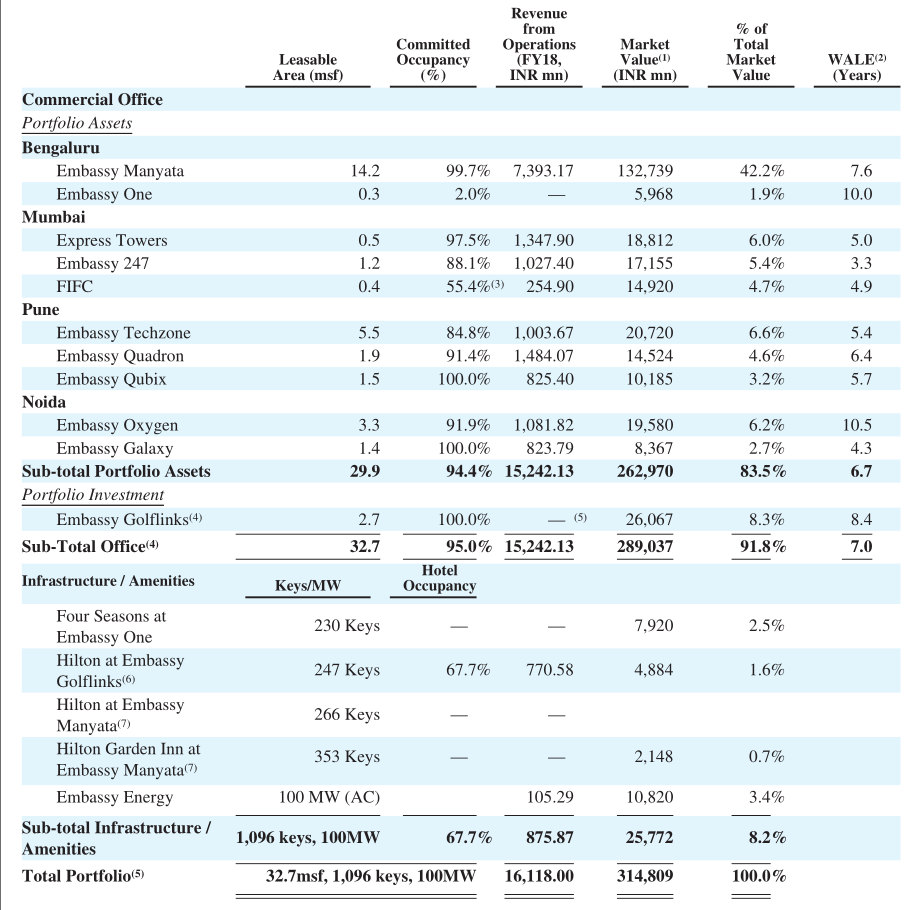

Before we look at the holding structure, it useful to know the list of properties that would come under the REIT.

Overall, the portfolio has a size of 3.2 crore sqft, with a previous operational revenue of Rs 1,600 crores and an assessed market value of Rs 31,500 crore. Do note that Embassy Manyata is almost 50% of everything – area, revenue and market value. Each line in the table above is owned by a specific company. Most of these SPVs are majority owned either by Embassy Group or Blackstone group, with a handful of minority shareholders. The biggest – Manyata – though is owned by both the groups with another significant minority shareholder. Overall, the current ownership has been mapped to the proposed holding structure. All the equity holders in the various companies would get units of the REIT – our analysis indicates that they would form a big majority of the unitholders.

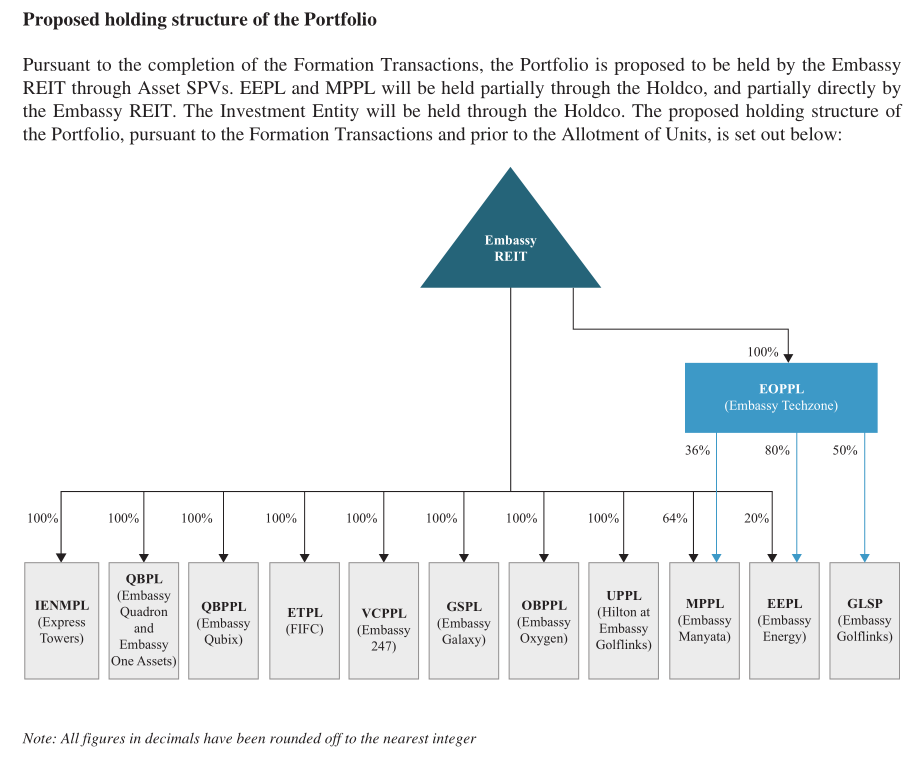

Proposed holding structure of the REIT

This REIT has another twist in the structure – Some of the major assets of the REIT are held indirectly via a Holding Company. The picture below provides details on the various holdings.

The SPVs till UPPL are straightforward. They would be owned 100% by the REIT. Due to the partial ownership of Embassy Manyata and Embassy Energy, these assets would be partially owned by the REIT, with the rest held indirectly by the holding company. We would revisit this important point later. Embassy Golflinks would be half-owned by an outside company and half-owned by the REIT.

IPO Parameters and Financials

It is important to note that the current shareholders of the various SPVs would be allotted units of the REIT in proportion to their equity capital. Only a minority portion of the number of units is available through the IPO. This factor is more akin to the typical stock market IPO – a portion of the ownership is made available.

The biggest parameter would then be the percentage of the portfolio ownership that is made available. However this information is not directly available in any of the public documents. By piecing together different information, we have estimated that about 16.8% of the REIT is available through the IPO. In effect, all the public unitholders are minority unitholders.

You can view the summary of the IPO in the typical Notice format here. The salient parameters of the IPO are below.

- IPO Size – Upto 4,750 crores; 12.96 crore units (excluding 2.9 crore units bought by Strategic Investors)

- IPO Price Band – 299 – 300 (Yes, it is not a typo – the band is that narrow)

- IPO Dates – Mar 18, 2019 to Mar 20, 2019

- Minimum bid quantity – 800 units (Rs 2.4 lacs) Additional bids are in lots of 400

- Allocation – At least 25% to non-institutional investors

- Equity value of portfolio – Rs 21,350 crore (this is less than the assessed market value)

- Number of units post-issue – About 77.17 crores crores

- Ownership available in IPO – 16.8% (12.96 crore out of 77.17 crore)

About 2.9 crore units have been allocated to 4 Strategic Investors at a price of Rs 300 per unit, before the issues was offered. About 5.8 crore units (out of 12.96 crore) have been allocated by the IPO managers to Anchor Investors, again at a price of Rs 300 per unit. We can for all practical purposes assume that the book building would be at Rs 300 per unit.

REIT – Expected Yield

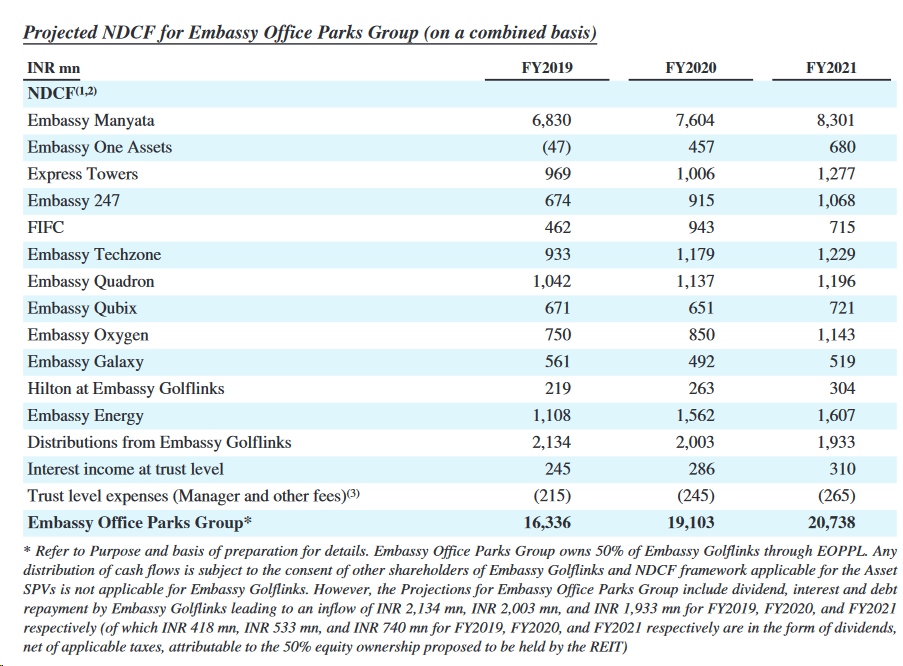

Net Distributable Cash Flow (NDCF) is a key parameter for REITs. There is a specif method to arrive at the NDCF of each SPV and the overall REIT. (This is documented in page 367 onwards in the offer document.) Any REIT has to distribute at least 90% of NDCF to the unitholders. Again taking the analogy of Equity IPO, the NDCF is equivalent to Net Profit projections. In equity, not al the profits are distributed as dividents; but in a REIT at least 90% of the NDCF has to be distributed, at least twice a year.

Let us use the FY2020 projections to estimate the possible yield from the units. All figures below are in rupees, except the number of units and yield

- Projected NCDF for FY2020 – 1910 crore

- Assumed distribution to unitholders at 90% – 1719 crore

- Number of units – 77,16,65,343

- Assumed NAV per unit – 300

- Net yield per unit – 22.32

- Projected yield in FY2020 – 7.44%

Assuming that the units may also have price appreciation, the yield is comparable to those from debt instruments. I have not yet analyzed how much of the NDCF would be tax-free in the hands of unitholders. Assuming that a portion of it is tax-free, the post-tax yield could be better than interest income from bonds.

The tremendous interest from Strategic and Anchor investors is another hint that the financials are attractive. Of the 15.83 crore units available to public, more than half have been bought by these investors. When the issues opens, a little more than 7 crore units would be available for bidding.

Operational Risks in the REIT

- Only some of the Embassy properties are part of the REIT. In Bangalore, Embassy Tech Village is a flagship and is not part of the REIT. Manyata – which is away from the other office clusters – is part of the REIT.

- Manyata is > 40% of the value of the REIT. However the REIT would own Manyata in two ways – 64% directly and 36% via a holding company. The holding company structure may be less tax efficient (to be verified)

- There are lots of buying out of smaller (read politicians) partners – they would get units in the REIT

- The manager of the REIT has a lot of leeway – expectedly. The Manager – Embassy Office Parks Management Services Private Limited – is very much controlled by the Embassy group. It is possible that the Manager may perform actions that are adverse to the REIT, but beneficial to the sponsors.

- The Manager has already been involved in managing the biggest asset – Embassy Manyata – and hence would have many operational ties to the Embassy group.

- Related party transactions are allowed and have to be voted by the unitholders if they exceed a threshold. While the units of the related party would not be considered in the voting, the two sponsors – Embassy and Blackstone – can scratch each other’s back and vote in favour of the other’s related party transactions

- One inference is that this REIT structure is closer to a typical company IPO (rather than a mutual fund AMC). There are lots of cross-holdings, promoter influence and definitely conflicts of interest. Basically the public investing in the REIT would be minority shareholders

- The Trustee takes the advice of the Manager in many matters. Theoretically it is possible to change the Trustee through voting. Since the sponsors hold a majority of the units, they can support the Trustees even if the minority unitholders don’t

- In short, this is as opaque as the typical real estate set-up. Unitholders of the REIT are probably as weak as the shareholders of a real estate company. However unlike a company, there are no protection for minority shareholders.

Taxation

This information is preliminary and would be revised as required. There are 3 income streams from the REIT: Dividend Income, Rental Income, Capital gains on sale of units. The REIT as such has a hybrid pass-through status.

- Income distributed by the holding company and SPVs – Tax free for REIT

- Rental income received by REIT from directly owned assets – Tax free for REIT

- Other income – Applicable rates

For resident Indian unitholder, the tax impacts are understood as follows:

- Distribution from Interest or Rental Income – Included in taxable income and taxed at marginal rate

- Dividend Income – Exempt from tax

- Capital Gains – Long-term capital gains exceeding INR 1 lakh on sale of units held for more than 36 months – 10%(plus applicable surcharge and cess)

- Short-term capital gains on sale of units held for up to 36 months – 15% (plus applicable surcharge and cess)

Summary

The financial parameters of the REIT look attractive. If the projections hold, the analysis indicates an yearly income comparable to, and possibly better than, debt funds. The operational structure provides many areas of conflicts of interest. Knowing the opaque nature of the industry as a whole, normal investors can skip the Embassy Office Parks REIT IPO. Investors with a large corpus, and are interested in acquiring high end real estate portfolio, can consider investing in the IPO.

I must say. This is actually quite an amazing analysis. I would suggest, if possible, you would make it more visually appealing. This type of an analysis would greatly benefit people !