FIRE – Financial Independence, Retire Early

(revised on 26 Feb 2024)

This long article describes a calculator that combines a set of factors to assess the feasibility of achieving financial freedom early in life. Financial Freedom (FF), or Financial Independence(FI) can be defined this way – the state of having sufficient personal wealth to live, without having to work actively for basic necessities as well as other life goals. The article has been updated to describe the latest version of the calculator, with additional reports.

(The earlier article can be seen here – (Older Version) Comprehensive calculator for Early Retirement)

In the phrase FIRE, I personally like the FI part more than the RE part. You could love your job and strive to be the best that you can be. You don’t have to retire early. But you can seek to achieve Financial Freedom as early as possible. This can then motivate you further in your career/venture.

The tool described in this post estimates the investment and corpus required to handle the following:

- Living expenses for the family (for a maximum of 55 years)

- School expenses for two children (as needed)

- College education for two children

- Higher education for two children

- Other major expenses like Vehicle, Vacation, Marriage, etc.

Why typical calculators don’t handle FIRE

In a typical retirement – say at or after 55 years – an individual would have completed most of the financial milestones- home, children education, etc. The only, or definitely the biggest, factor would be the corpus to fund the living expenses.

In an early retirement scenario, say 45 years, many of the other goals would be unmet. The corpus will have to address these goals as well as retirement needs. Considering the long years in retirement, the withdrawal strategy also has to be sophisticated. The typical calculators suggest one asset allocation during the accumulation phase, and expect you to redeploy the assets differently during the withdrawal phase; this too becomes complicated in an early retirement scenario.

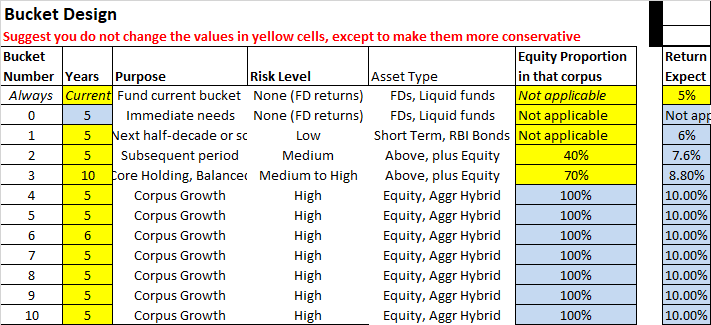

Bucket Strategy

Since we are talking about early retirement, we can assume that the person can still actively manage the corpus. The Bucket Strategy to manage retirement corpus requires the person divides the corpus into various buckets. The person parks or invests the buckets appropriately. By using the bucket strategy, we can ensure/hope that the corpus actually has post-inflation growth even during retirement.

- Bucket 1 – Living expenses and other cash flow for first 5 years – FDs, Liquid funds

- Buckets 2 & 3 – Living expenses and other cash flow for the next 10 years – Short duration funds, Locked products like RBI bonds, etc.

- Buckets 4 & 5 – Living expenses and other cash flow for the next 10 years – Mix of debt and equity

- Bucket 6 and beyond – Rest of the corpus – More aggressive equity

After five years, you need to pull down all the buckets a notch and reshuffle. The process is then repeated every 5 years. Of course, you can design the buckets a bit differently. You can be more active in the first 3 buckets too. But overall, you would plan to have the corpus invested in different assets and growing at different rates.

Note:

This somewhat-complex calculator is derived from some of the fantastic calculators available at freefincal.com. A full list of the articles is given at the end of the post.

Approach – Bucket Strategy Calculator for ‘Early Retirement’

This tool seeks to apply the bucket strategy to major goals as well as retirement. (A corollary of the approach is that there is a single portfolio for all the goals. This by itself can lead to a lot of simplicity in how the corpus is managed.) I developed this for my personal situation. My first child was still in school when I achieved Financial Freedom. (I could have chosen to retire at that time, continue working or take a different career – that does not change the goal of financial freedom.) My second child is 3 years later in education. So in the first 12 years of FF, I would have many large expenses related to my children.

My retirement corpus (along with rental income) seems sufficient to follow the typical income drawdown strategy to meet the living expenses. I have built a corpus that again seems sufficient for my children’s’ college education and either higher education or marriage. I wanted to push further and see if I can meet all the goals, and also throw in expensive vacations. The FIRE calculator helped me assess that. The typical calculators are not helpful since they mostly consider living expenses alone. I took some great calculators from freefincal.com and added some more. I came up with a reasonably complex calculator that can tell you if you are on track for financial freedom. The original freefincal blog posts have detailed, useful information on the calculators. Please look up the references.

Illustration used

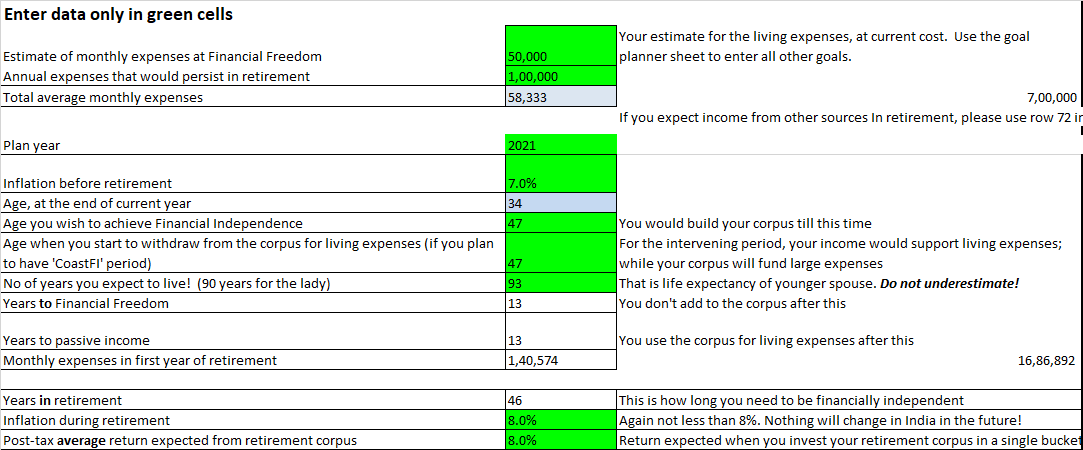

The calculator has pre-filled data for a scenario. These are the details:

- Earner is 34 years young and seeks to achieve Financial Freedom at 47

- The retirement corpus is expected to last till the younger (by 3 years) spouse is 90 years young (The tool makes no assumptions on the salary and employment status of the spouses. For simplicity, the elder spouse’s age is captured in the tool.)

- First child is expected to go to college in 14 years; the second child is 3 years younger

- Current annual expenses (adjusted for FF lifestyle) are 7 lacs (This should exclude vacation, school expenses, etc.)

- The family has made some investments towards the goals and the current corpus is known

- The tool makes no assumptions on the salary; you have to decide if your income is sufficient to make the required investments

- For simplicity, we assume that all expenses till retirement (including major expenses) are funded from the active income and other sources. It is straightforward to build a separate corpus for these, if required

Step-by-step intro to the calculator

The first sheet provides the sequence of steps suggested to use the calculator. We would look at them in sequence. In the description below, screenshots are included; please follow along with the calculator. Or better still, enter your own values in the calculator after downloading it from the button below. (Note: Please use version 4.9 of the calculator. The calculator works better with Office 2013 or later)

Step 1: Provide inputs for overall situation till row 16 in Retirement_Inputs sheet – age, FF target, expenses, inflation and return expectations, etc.

(This version of the calculator can also take inputs for multiple currencies. These are not described in the article.)

Step 2:

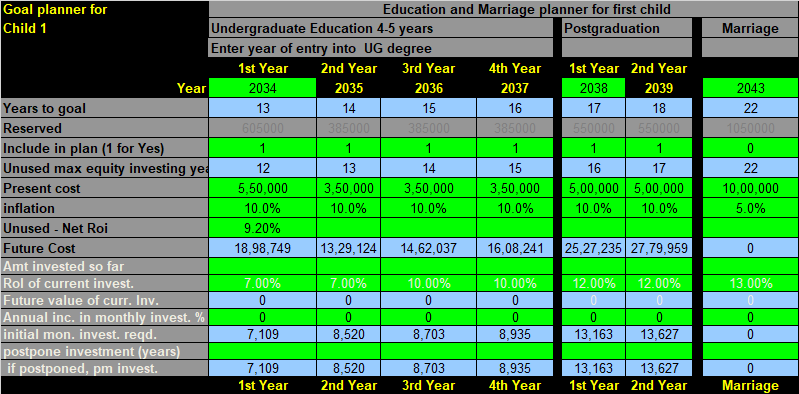

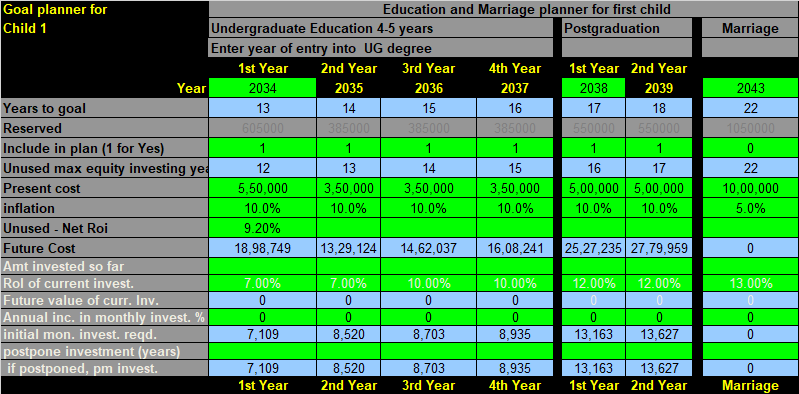

Provide inputs for goals for children. An interesting feature of this approach is the split of education expenses into different years. Typically, there are larger expenses for the first year of college than later years. The figures in the illustration are adequate for an engineering education.

Note: A flag can be used to exclude the goal from the plan. For illustration, the Marriage goal has been excluded from the plan.

Step 2

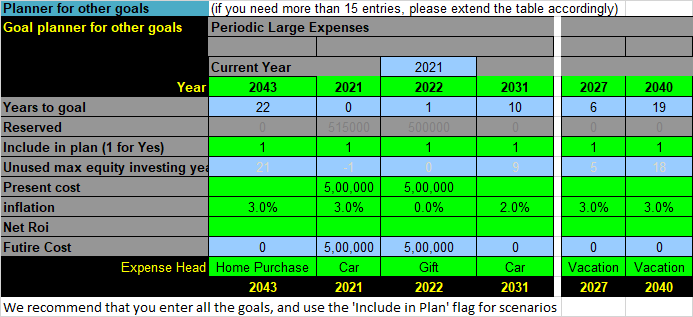

Step 3: Provide inputs for other expenses, inflows and income. There could be some periodic inflows – ill-advised insurance plans, etc. For these, use -ve values and set inflation to zero.

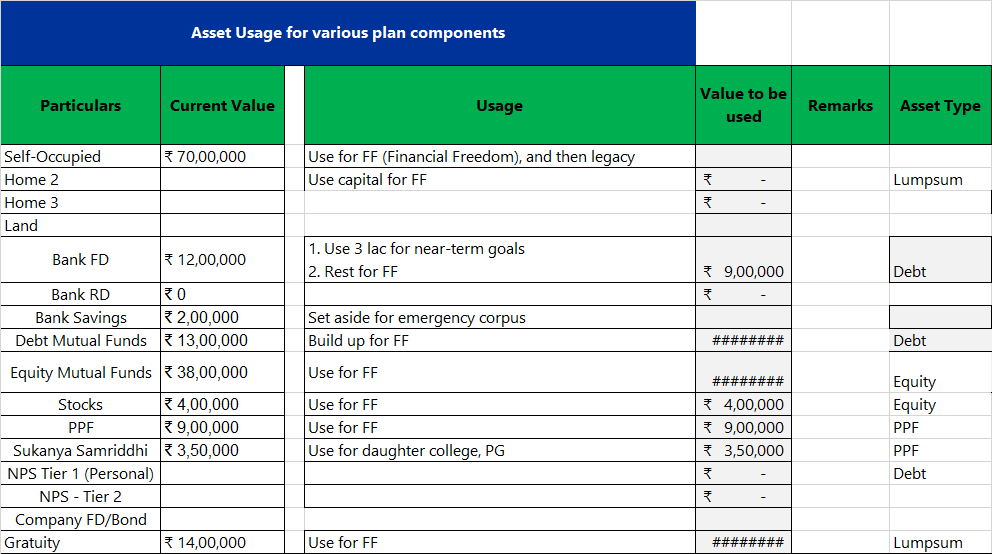

Step 3B: Provide inputs for regular income during retirement ages. You can input upto four different income streams.

Step 4a: Provide inputs on the current corpus. Since the calculator considers equity, taxable debt and tax-free debt, you need the corpus split into these categories. For ease of analysis, this version introduces a table. This table, and other useful tables, are found in the AssetUsage sheet. In addition to entering the value of the assets, you can also use specific columns to control the value to be used, and the type of asset. Examples in the sheet should be self-explanatory.

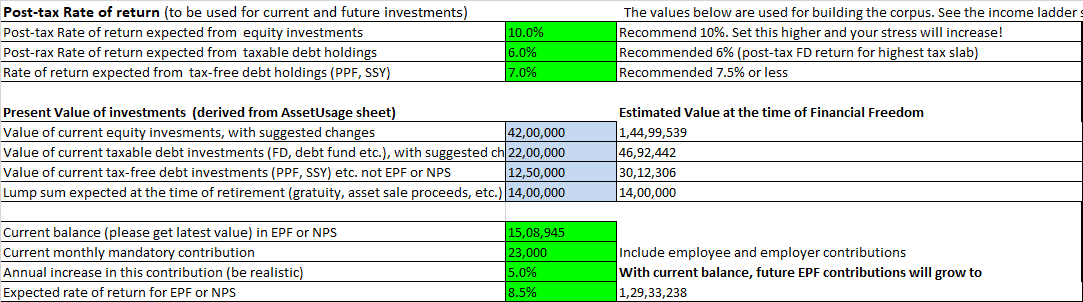

Step 4b: Provide inputs on the XIRR assumptions.It would be best to leave the XIRR values as they are. Increasing them would reduce the required investment, and make the plan look more feasible, but would also increase the stress. Please note that the asset value cells are populated from the AssetUsage sheet.

Now it is the time to review the calculations.

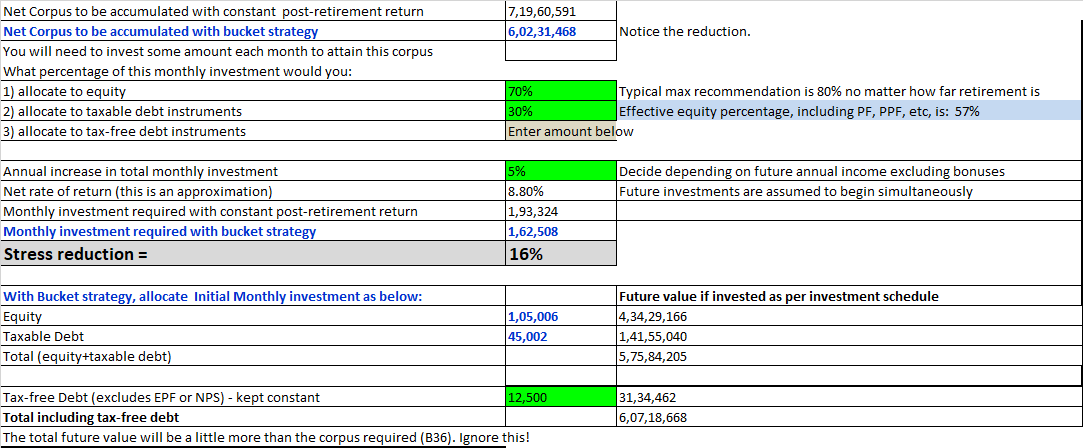

Step 5a: Review the estimated corpus, and investment required to build it. You can adjust the allocations to equity and debt. The approach in this calculator does not require the typical 100-age guideline for equity. If you already have a large debt corpus, you can be more aggressive in equity. Please spend time in adjusting the allocation; but keep the stress factor in mind. Having a large equity allocation would increase the stress. The calculator assumes that investment in PPF, SSY, etc. is kept constant year-on-year while investments in other assets increase.

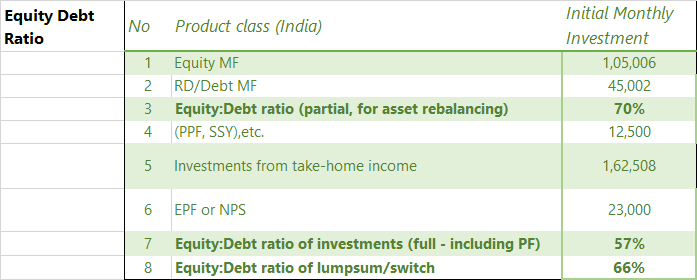

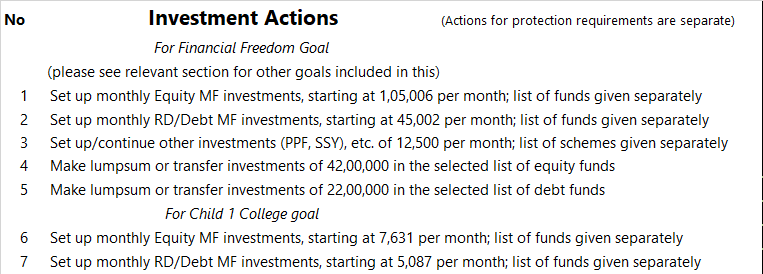

If the family can invest about 1.62 lac rupees a month, they can meet the retirement plan. If this amount seems too high, you can review the goals and see what could be given up. For example, you can decide to take loans for higher education and adjust the goal for that. Of course, you can always postpone the goal of financial freedom. In this example, if this goal is set at 52 years (5 years more), the required monthly investment is much lower.

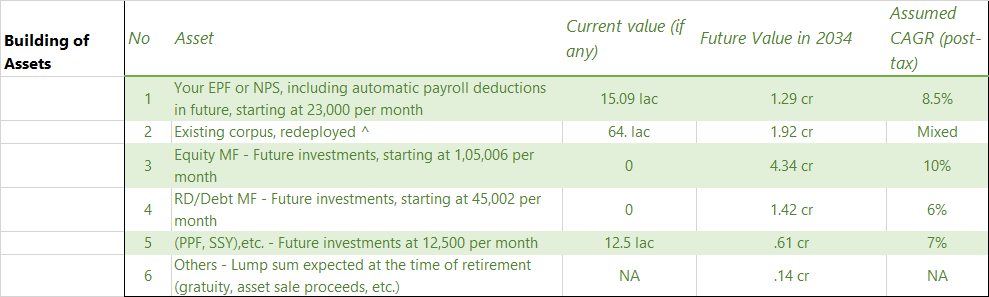

Step 5b: Review how the corpus would be built, equity:debt ratio of investments, etc. These tables are in the AssetUsage sheet.

You can also review the helpful table on Investment Actions. You can also derive a table of specific products.

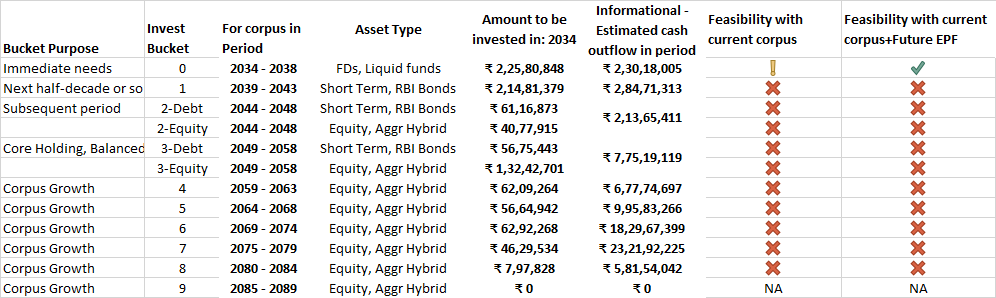

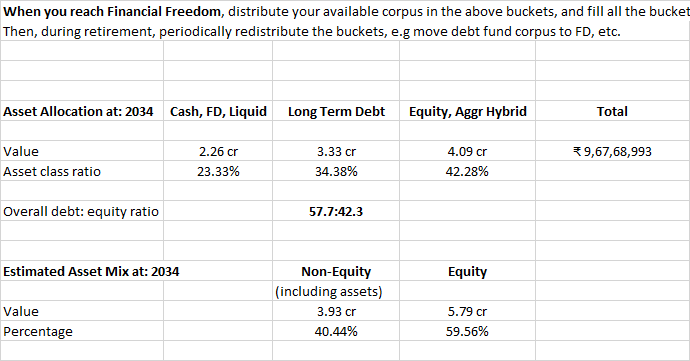

Step 6: Review the corpus deployment sheet (named Subjective-Stress-Reducer) and count the green ticks. You can see how prepared you are to take the FF plunge. This step should be done before you start using the recommendations from the calculator. The sheet looks at the current corpus only and does not take into account the future investments except EPF. A very important factor here is the corpus in debt and equity. You can see that there are large outflows in the first decade and hence a large corpus is required in debt.

In the illustration, the family is just about on the path and is still far away from the required corpus. But the 10+ years of disciplined investment could get them closer.

The traditional version has distinct accumulation and deployment phases. The corpus is redeployed on retirement. The aggressive version assumes that the corpus is continuously deployed in the required asset classes, while it is being accumulated. A table in the same sheet provides a modeling of this. As you get closer to the goal of financial freedom, you should look to reduce the gap between the two tables.

And that is it. Hopefully you could follow along till now.

Did you find the article useful? Please share your comments below.

For the adventurous – Calculation Details

If you are curious, please explore the last two sheets that have the bulk of the calculations.

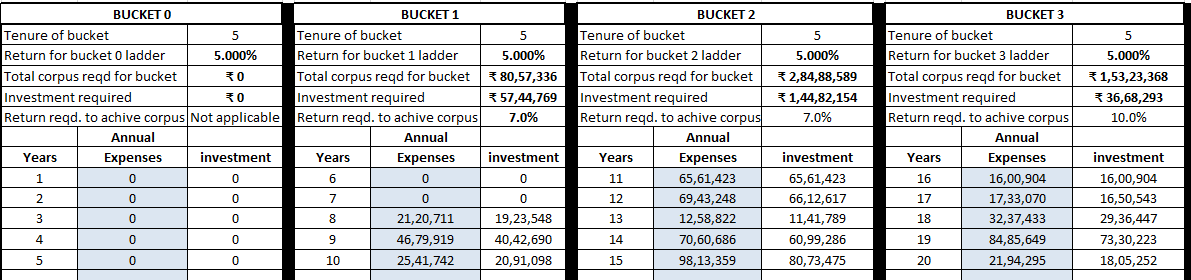

The income ladder sheet lays out the corpus calculations based on the buckets. For each bucket of 5 years, the net cash flow is used to calculate the corpus required for the bucket, and the investment required to build the corpus. Column K in the table holds the most critical information – expected returns to build the various buckets. The values here are realistic, considering the impact of taxation.

- 10% post-tax return for equity investments

- 6% post-tax return for debt instruments

- 5% post-tax return for each bucket

You can scroll to the right to see how the various buckets look. I can’t thank Pattabiraman Murari enough for the lay-out of the buckets. This detailed layout seems to be the only way to get the bucket strategy estimation done correctly. The lazier approach of using a single formula for the entire period would not help.

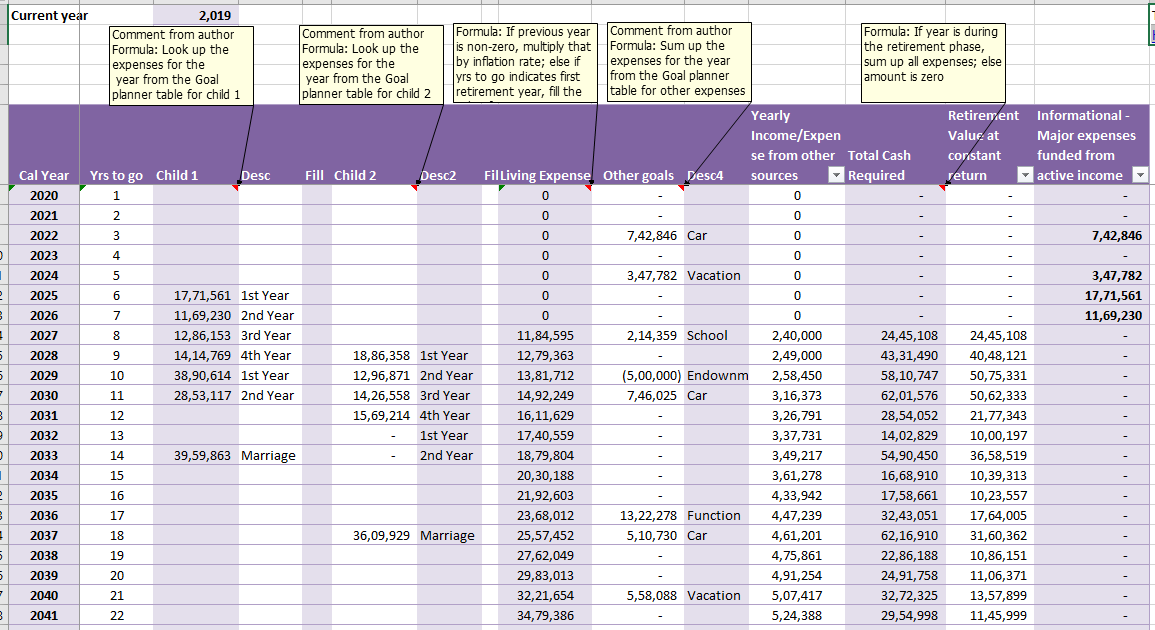

The last sheet – YearlyCashFlow – lists the required cash flow during the period of the calculator. It picks up the data from the goal planner sheet and adds the estimate of living expenses and other income. The net cash flow for the year is used in the bucket calculations. The comments at the top provide explanations on the formulae used. This sheet uses the table structure; if you change the formula in one cell, the entire column would reflect that change.

References

- https://freefincal.com/the-retiremen…egy-simulator/

- https://freefincal.com/can-retire-rs-one-crore-today/

- https://freefincal.com/inflation-pro…ement-annuity/

- https://freefincal.com/retirement-calculator/

- https://freefincal.com/e-book-post-r…on-strategies/

Additional Reading: How I built the calculator

If you have already used calculators from freefincal.com, the following section would be helpful to explain the approach and the changes.

-

The calculators always start with the inputs for retirement planning. For any person earning income, this is always Goal # 1.

-

I took the goal planner sheets from 2012 to reflect other requirements. (https://freefincal.com/goal-planners-2/) One of the sheets has the template for staggering education expenses into many years. To this I also added a table to capture some non-recurring expenditure like vehicle, vacati on, etc. The sheet can be used standalone for detailed calculations for education goals. For the purpose of financial freedom, the most relevant information is the corpus required for a particular year.

-

I then merged this into the bucket strategy simulator for retirement. (https://freefincal.com/the-even-lowe…nt-calculator/) In fact the new calculator is an attempt to validate the assertion at the end of the first paragraph: The reduction could be higher for early retirement.

-

I had to modify some of the formulae in the sheet to pick amounts for all the goals. These modifications are marked in light blue fill. More than 90% of the information in the sheet is retained from the original version.

-

I created a new sheet that captures yearly outflows under various heads – Education, Retirement, others, etc. This is the last sheet in the file. Since the calculator is for all goals, there could be large variations in yearly expenses.

-

I extended the buckets to a total of 11 years. If each bucket is for 5 years, then the calculator can be used for a period upto 55 years from now. I also modified the relevant cells to pick the expense amount for that year from the cashflow sheet.

-

When the calculations from the buckets are plugged back, the Retirement_Inputs sheet gives a clear idea of the net corpus required, and the monthly investments required to achieve that corpus. If this monthly investment can be met, then it is feasible to achieve early financial freedom.

-

The ‘Stress Reducer’ sheet seeks to provide an overview of the corpus required and where it can be invested. If you have sufficient corpus to get 4 or more ticks, you can consider that you are at the Financial Freedom threshold. This step should be done closer to the date of FF. The sheet looks at the current corpus only and does not take into account the future investments except EPF.

Looking for content related to financial planning and fire