While it is an unfortunate fact that not many Indians plan for their retirement, there is a more worrisome fact. Even among the few who do plan their retirement, a large majority do it the wrong way by choosing one of the various pension plans. In this short article, we see the major disadvantages of pension schemes in India.

Basic Structure of Pension Plans

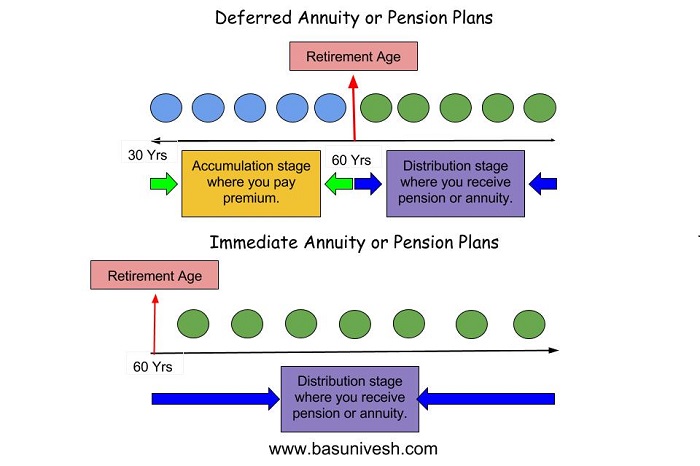

There is a level of ambiguity in the usage of word ‘pension plan’ in India. Most of the schemes that have the word pension in them are in fact ‘accumulation plans’. The ‘investor’ – if you can use that word – makes periodic purchases to build up a corpus. During the accumulation period, the investments are managed by the scheme provider to generate a level of returns. At the time of retirement, the distribution phase begins. The final corpus is a combination of the purchases and the returns. This corpus – or a part of it – is actually used to buy an annuity. It is this annuity that actually provides a pension! This picture from https://www.basunivesh.com provides a pictorial view of the phases.

When you buy a pension plan, you are forced to buy an Annuity Plan at some point of time. This article has more information on annuity plans. Annuity Plans – What, Why, and Why Bother Another view of this with specific reference to NPS is provided by this freefincal article.

Disadvantages of pension plans

No estimate of annuity amount

No exclusivity

Tax treatment

Conclusion

Any person planning for retirement can choose from a variety of other mechanisms to build the corpus. At the time of retirement, they can choose the best way to get an inflation proof income. (Read this article.) This is far more flexible than getting locked into a pension plan.

A notable exception is the recently introduced Atal Pension Yojana – this plan determines both the monthly amount and the pension at the same time. Please note that APY is primarily aimed at the people working in unorganized and informal sectors.

1 thought on “Pension Plans – Why you should avoid them in India”