Flat-Fee Financial Planning and Investment Advisory

SriNivesh Advisors is SEBI registered Investment Adviser (RIA), with registration number INA200013132. We provide comprehensive financial planning and investment advisory services for individuals and HUFs. This FAQ provides answers to some frequently asked questions on our services and plans.

SriNivesh Advisors - Services and Plans

We are flat-fee (fee-only) planners and are not associated with a particular product. We provide a comprehensive financial and investment plan that spans across various product type. As a flat-fee-only planner we do not receive any commissions or other income from the products that we recommend, and we can offer conflict-free advice. We are one of the few dozens of individual planners in this category (Fee-Only India) A vast majority of the planners in India earn from commissions and incentives.

This page provides more details on fee-only planning and advisory.

We provide comprehensive financial planning and investment advisory services for individuals and HUFs. We offer a range of service plans tailored for various needs. Our planning and advice is customized and individualized. Please see 'Plans and Fees' page for a description of our services. If you have a requirement that is not explicitly listed, please contact us with the requirement.

Financial Planning is an ongoing process to help you make sensible decisions about money that can help you achieve your goals in life; it's not just about buying products. (courtesy Chartered Institute for Securities & Investment) Our services cover various aspects of planning:

- Risk Profiling

- Review of existing assets and liabilities

- Counseling for removing unproductive assets

- Assessment of Financial Goals (retirement, child education, home purchase, etc.)

- Prioritization of Financial Goals

- Goal Affordability

- Goal-based Investment Advice

- Customized Asset Allocation

- Emergency/Liquidity Planning

- Detailed Investment Plan (including mutual funds, and other products)

- Review of Existing Life Insurance products; Review of existing Health and Disability Insurance

- Insurance Adequacy Assessment

- And many more

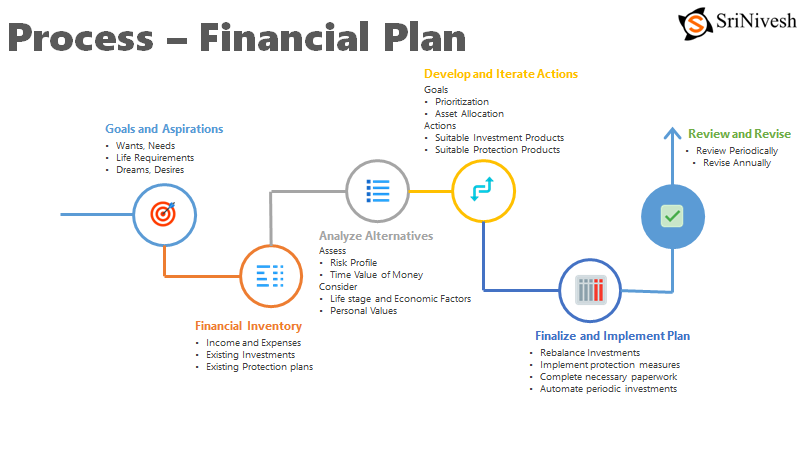

This picture provides an overview of the planning approach that we use. We work closely with you at each step of the process to develop the most optimized plan for your requirements.

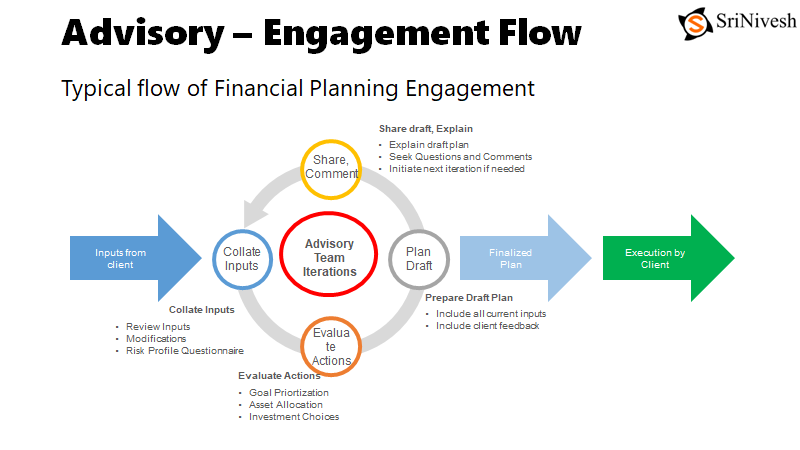

We start by collecting a set of inputs from you. These cover many aspects of your financial situation. We use the inputs to develop a draft plan. We review the plan with you, include your feedack and develop the next draft. We finalize the plan after you have understood the plan and are able to execute it.

We expect to have 5 online discussions (50 mins each) during the varous steps of the process. This is in addition to the preparatory and analysis work that we do offline.

The picture below provides an overview of the flow.

We finalize the plan after you completely understand it. We provide a detailed list of actions. It is quite simple to implement these steps. As a flat-fee-only planner, we do not implement the plan for you. We would put you in touch with appropriate implementation platforms - Insurance Aggregators, Direct Mutual Fund Platforms, etc.

Through the year, you can consult with us on any aspect of the implementation.

We use a combination of open source tools and customized calculators to analyze the inputs and create a comprehensive plan. Many of our tools are inspired by Freefincal

The tools are one of the factors that affect the quality of the plan. The process used to create the plan, customization to your requirements, and the knowledge of the planner are other major factors that contribute to the quality of the plan.

We treat our client information with utmost confidentiality and would not share this data at any time. We can provide you with sample plans on request.

Our companion site - SriNivesh Blog - has a variety of articles that detail our approach. You can read the following articles for more background on our approach.