Advisory and Financial Planning

SriNivesh Advisors is SEBI registered Investment Adviser (RIA), with registration number INA200013132. We provide comprehensive financial planning and investment advisory services for individuals and HUFs; the services are provided in a transparent fixed-fee model.

We offer a range of service plans tailored for various needs. Our planning and advice is customized and individualized. Please see 'Plans and Fees' page for a description of our services.

Please schedule a free, no-obligation discussion with us to get started. Contact Us

Financial Planning is an ongoing process to help you make sensible decisions about money that can help you achieve your goals in life; it's not just about buying products. (courtesy Chartered Institute for Securities & Investment) You can choose to create the plan yourself, or take the help of an advisor/financial planner. A professional planner can help you develop a comprehensive financial plan. Per SEBI, “financial planning” shall include analysis of clients’ current financial situation, identification of their financial goals, and developing and recommending financial strategies to realise such goals.

We adapt a holistic approach to Financial Planning.

SEBI's regulations include financial planning under Investment Advice and defines it this way: "Advice relating to investing in, purchasing, selling or otherwise dealing in securities or investment products, and advice on investment portfolio containing securities or investment products, whether written, oral or through any other means of communication for the benefit of the client and shall include financial planning."

SEBI has strict registration requirements for advisors who provide these services. Professional who comply with the requirements and obtain registration from SEBI can call themselves Registered Investment Advisors (RIA). This document from SEBI list the do's and don't of investors seeking advice. "Always deal with SEBI registered Investment Advisers."

A fee-only planner is someone who charges a fee for financial plan creation and advisory and does not receive any kind of commissions/incentives from mutual fund houses, insurers or other financial product sellers. Financial advice is provided and clients are expected to take necessary action on their own. (Courtesy freefincal) A fee-only planner can act as a Fiduciary - placing your interests above their own interests.

We practice a fixed-fee model. We charge a transparent, 'flat fee' that compensates us for the effort. The fee is not based on the assets and networth of the client.

Flxed-Fee Financial Planning and Investment Advisory

This FAQ section provides answers to some frequently asked questions on our services and plans.

SriNivesh Advisors - Services and Plans

We are fixed-fee (fee-only) planners and are not associated with a particular product. We provide a comprehensive and holistic financial and investment plan that spans across various product type. As a fixed-fee-only planner we do not receive any commissions or other income from the products that we recommend, and we can offer conflict-free advice. We are one of the few dozens of individual planners in this category (Fee-Only India) A vast majority of the planners in India earn from commissions and incentives.

We provide comprehensive financial planning and investment advisory services for individuals and HUFs. We offer a range of service plans tailored for various needs. Our planning and advice is customized and individualized. Please see 'Plans and Fees' page for a description of our services. If you have a requirement that is not explicitly listed, please contact us with the requirement.

Financial Planning is an ongoing process to help you make sensible decisions about money that can help you achieve your goals in life; it's not just about buying products. (courtesy Chartered Institute for Securities & Investment) Our services cover various aspects of planning:

- Risk Profiling

- Review of existing assets and liabilities

- Counseling for removing unproductive assets

- Assessment of Financial Goals (retirement, child education, home purchase, etc.)

- Prioritization of Financial Goals

- Goal Affordability

- Goal-based Investment Advice

- Customized Asset Allocation

- Emergency/Liquidity Planning

- Detailed Investment Plan (including mutual funds, and other products)

- Review of Existing Life Insurance products; Review of existing Health and Disability Insurance

- Insurance Adequacy Assessment

- And many more

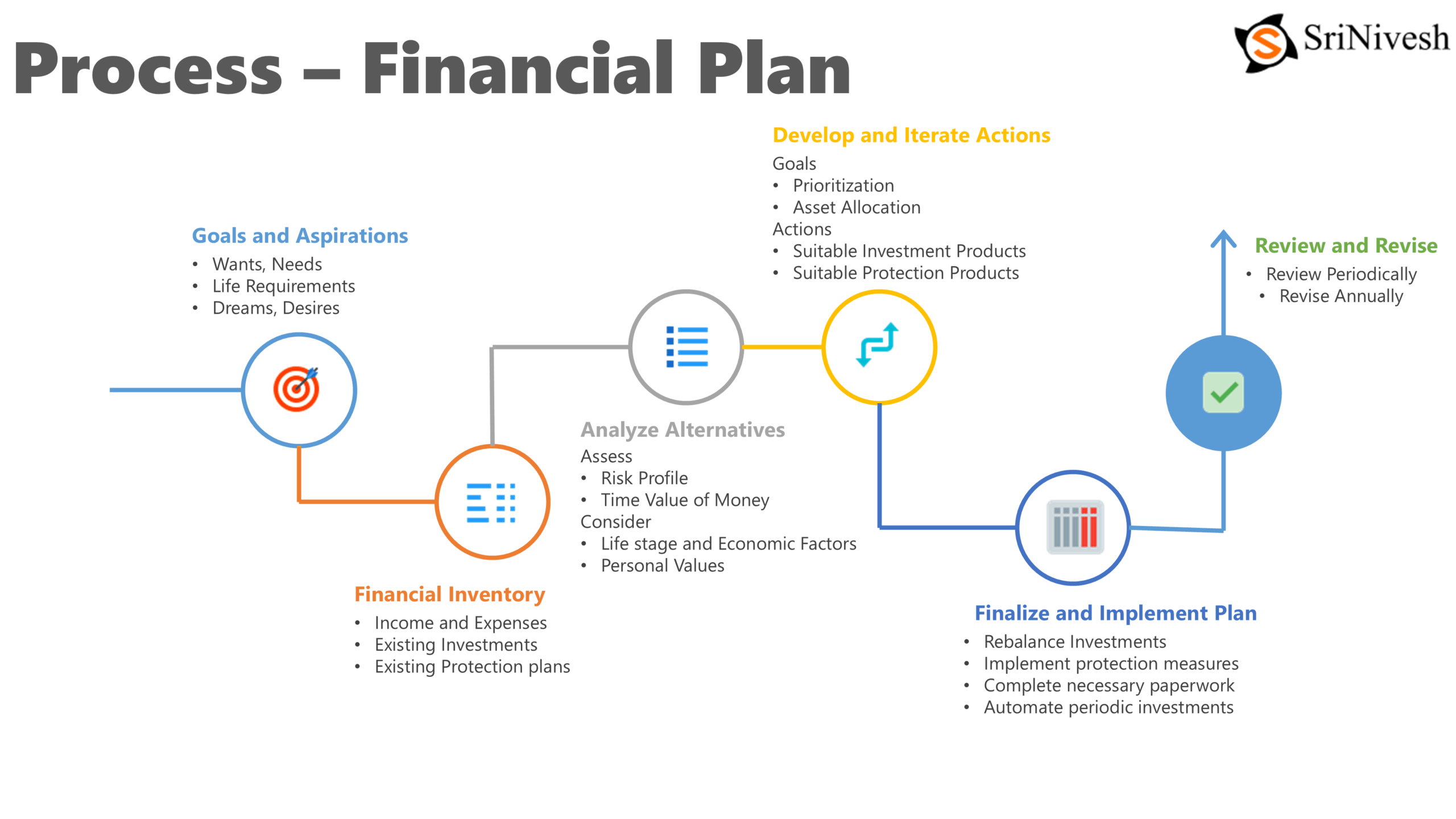

This picture provides an overview of the planning approach that we use. We work closely with you at each step of the process to develop the most optimized plan for your requirements.

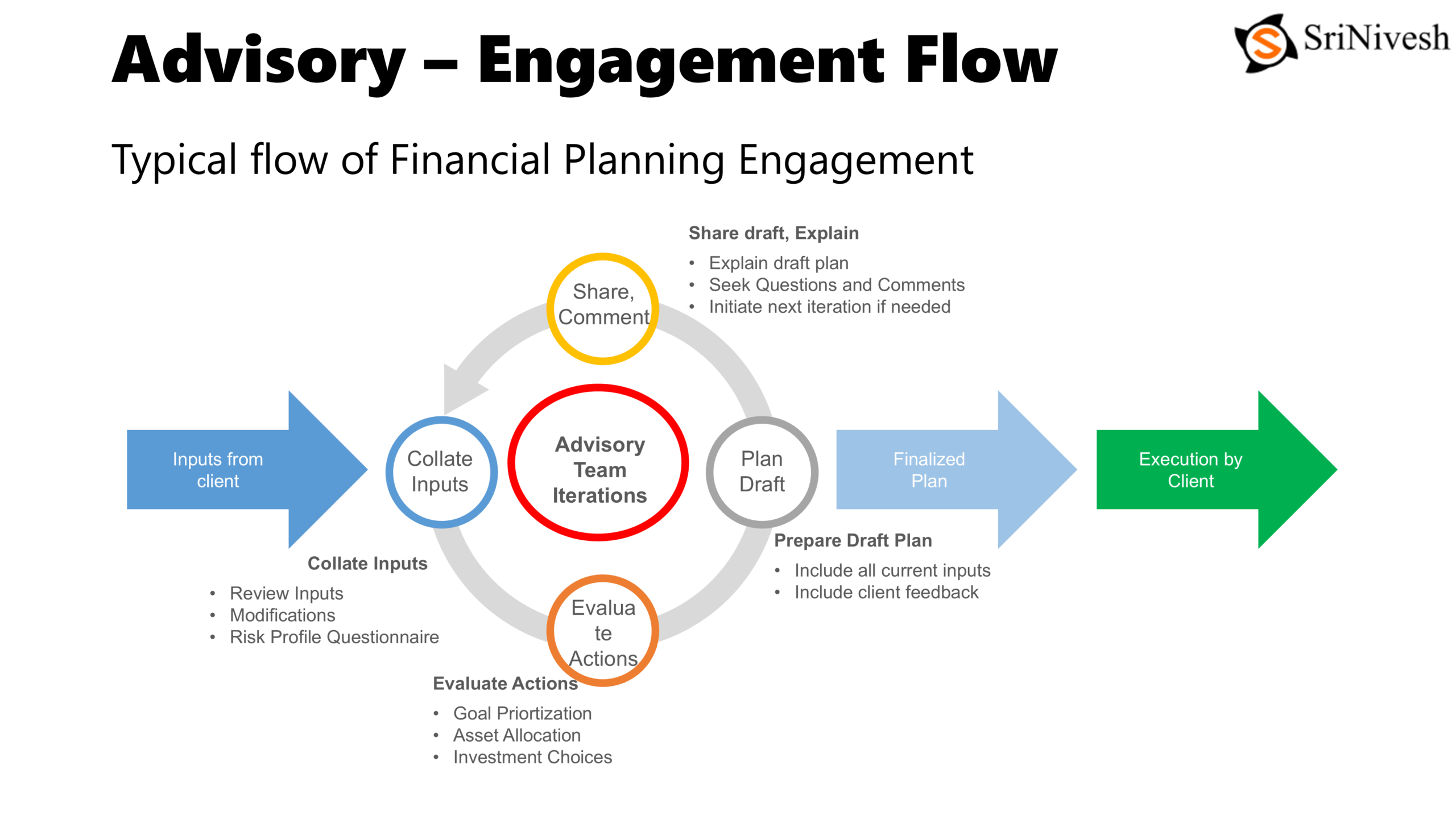

We start by collecting a set of inputs from you. These cover many aspects of your financial situation. We use the inputs to develop a draft plan. We review the plan with you, include your feedack and develop the next draft. We finalize the plan after you have understood the plan and are able to execute it.

We expect to have 5 online discussions (50 mins each) during the varous steps of the process. This is in addition to the preparatory and analysis work that we do offline.

The picture below provides an overview of the flow.

We finalize the plan after you completely understand it. We provide a detailed list of actions. It is quite simple to implement these steps. As a flat-fee-only planner, we do not implement the plan for you. We would put you in touch with appropriate implementation platforms - Insurance Aggregators, Direct Mutual Fund Platforms, etc.

Through the year, you can consult with us on any aspect of the implementation.

We use a combination of open source tools and customized calculators to analyze the inputs and create a comprehensive plan. Many of our tools are inspired by Freefincal

The tools are one of the factors that affect the quality of the plan. The process used to create the plan, customization to your requirements, and the knowledge of the planner are other major factors that contribute to the quality of the plan.

We treat our client information with utmost confidentiality and would not share this data at any time. We can provide you with sample plans on request.

Our companion site - SriNivesh Blog - has a variety of articles that detail our approach. You can read the following articles for more background on our approach.

Fee-only Planners and Advisors

This FAQ section provides answers to some frequently asked questions on fee-only financial planners.

Fee-Only Planner/Advisor

A fee-only planner is a Financial Planner/Advisor who charges a fee for their services related to financial and investment planning. Such a planner does not receive any commissions or other income from the products they recommend.

There are many small and large differences in the usage of these terms. In this site, these terms are used almost interchangeably. The language used by SEBI includes 'Financial Planning' under 'Investment Advice'. We describe our advisory services to include both financial planning and investment advisory.

A fee-only advisor takes a fee from the client and provides advice. Since they earn nothing else based on the advice provided, they can be trusted to put the interest of their client above their personal interest. A fee-only planner acts in a 'Fiduciary' capacity. A fiduciary is a person who holds a legal or ethical relationship of trust with another person. In personal finance, a fiduciary advisor is some one who places the interests of her client above her own interests.

Most financial advice in India is given out by people who earn incentives, commissions, etc. from the investments that they recommend. These planners/advisors earn commissions from the products that they recommend. To the investor, their advice is seen as 'free of cost'. A subset of them also charge fess to their clients. They are called 'fee-based' planners.

We also hear another common term – Independent Financial Advisors (IFA). This term has a regulatory meaning in the United Kingdrom. In India, it is loosely used to denote advisors who are not employees/partners of any firm. Many of the self-described IFAs deal with mutual funds.

SEBI is the authority regulating financial planners. They have defined 'Investment Advisers' as those who charge a fee for their advice and earn nothing from the investments that they recommend. People who meet the regulatory requirements and obtain a registration from SEBI can call themselves as Registered Investment Advisors (RIA).

The spirit of the regulations discourage 'fee-based planners'. The regulations also restrict 'free planners' to specific incidental activities. In the planned regulatory updates, SEBI has specified that only RIAs can use the word Advisor.

Mandatory certifications required by authorities like SEBI, and the additional employer-required certifications, typically ensure that individual advisors (whether employees/partners/independent) have a reasonable amount of knowledge and competence in the relevant areas. Lack of sufficient knowledge is seldom the reason for poor advice. There is no evidence to show that fee-only planners are more knowledgeable.

As recently as Nov 2018, SEBI put out a list of do’s and dont’s for dealing with Investment AdvisersSome of them are included below.

1.Always deal with SEBI registered Investment Advisers.

2.Check for SEBI registration number. …

4.Pay only advisory fees to your Investment Adviser. ….

11. Do not deal with unregistered entities.

12.Don’t fall for stock tips offered under the pretext of investment advice.

13.Do not give your money for investment to the Investment Adviser. …

If you have read this far, you are hopefully motivated to shun free, possibly-biased advice in favor of fee-only advice. Fee-Only India is an association of financial planners who do not sell any products or earn commissions, and work purely in the client's best interest. Please review the list and choose any one that you are comfortable with.

You can read these articles to get a start.

- What You Need To Know Before Hiring a Financial Advisor

- Curated List of Fee-Only Financial Planners in India

- List of questions that you can ask an advisor before selecting them

Our blog has an article that argues that 'free advice' may be expensive.