Best Mutual Funds?

‘Best Mutual Fund’ is one of the most common question/search term in personal finance. There are tons of sites that offer a list of Best Mutual Funds, Best Largecap Funds, Best Liquid Funds, etc. Most, but not all, of these sites also list the parameters that they have used to come up with their selection. An earlier post – Best Mutual Funds – Selection Guide– looked at some parameters that can be used to shortlist ‘better’ equity mutual funds. In this article we look at an easy and quick way to shortlist mutual funds using CRISIL Rankings.

First Things First

-

The financial goal(s) that you have

-

Time available to build the corpus

-

Your expected return

-

Your tolerance to volatility

-

Your ability to stay invested and stay focused

-

and more…

CRISIL Mutual Fund Rankings

The intro to the website – CRISIL Ranking– mentions this.

Our methodology for CRISIL Mutual Fund Ranking (CMFR) is based on global best practices. It was launched in June 2000 and since then it has gained high acceptance among investors, intermediaries and asset management companies.

The rankings use a list of factors that include returns, volatility, portfolio construction, etc. A very important point to note is that the rankings consider 3-year records for equity mutual funds. Even in the 3 year period. return for the trailing 36 months has the largest weight-age in the calculation. This can, and does, make the methodology favour recent performance over long term performance.

The ranks themselves are straightforward. The website mentions this:

The ranks are assigned on a scale of 1 to 5, with CRISIL Fund Rank 1 indicating ‘very good performance’. In any peer group, the top 10 percentile of funds are ranked as CRISIL Fund Rank 1 and the next 20 percentile as CRISIL Fund Rank 2.

So ranks 1 and 2 cover the top 30% of the mutual funds. This seems like a good enough shortlist – again if you are comfortable with using 3 year track record alone.

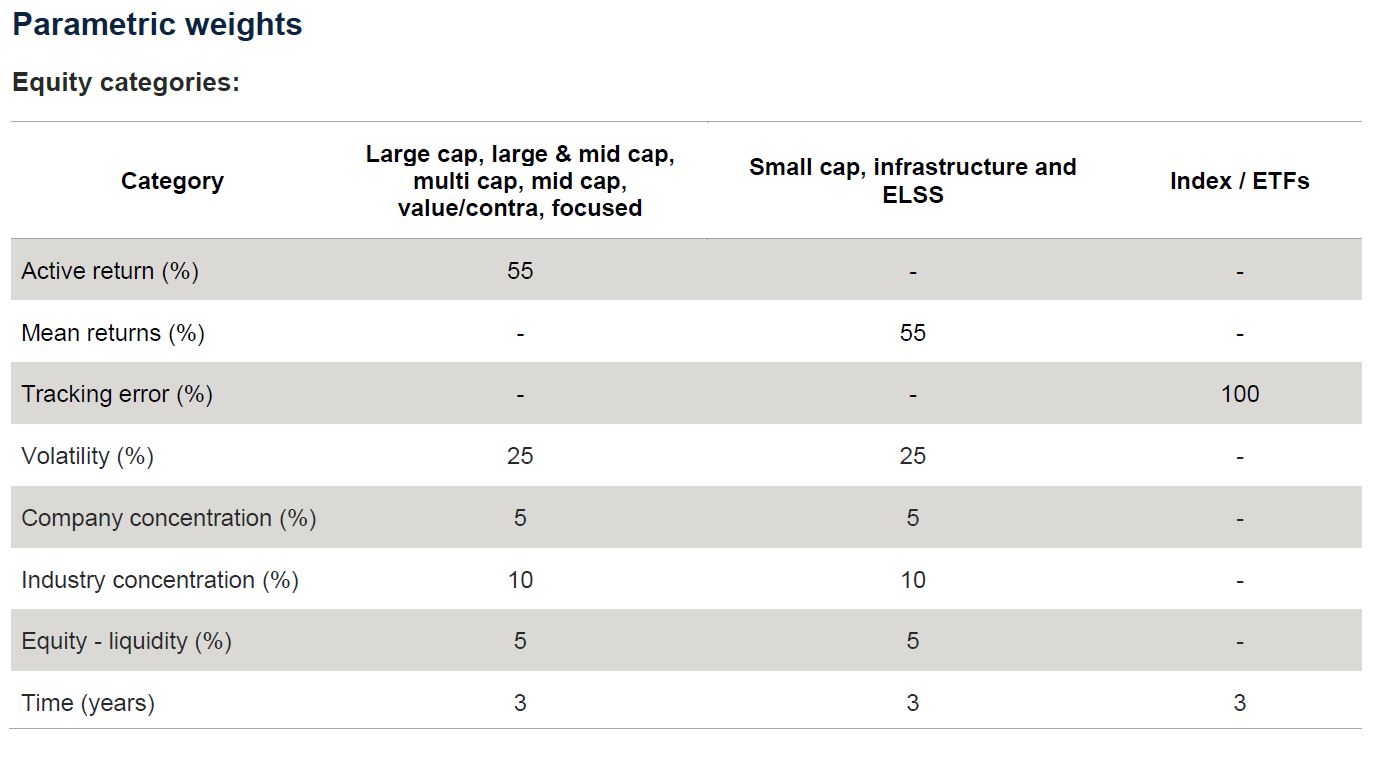

Parameters used in ranking

CRISIL publishes the ranking methodology used here.

For equity funds, the factors include: returns, volatility, portfolio construction, and others. Returns have a weightage of 55% and volatility has a weightage of 25%. Below is a snapshot from the document.

As you can see, the time period used is 3 years. For returns: “The period of analysis is broken into four overlapping periods – latest 36, 27, 18 and 9 months. Each period is assigned a progressive weight starting from the longest period as follows: 32.5%, 27.5%, 22.5% and 17.5%, respectively.” So the 3 year performance has the highest weight. We can see an example of this later.

Due to the 2018 changes in categorization, active returns (returns compared with the respective CRISIl index) is used for most funds. For simplicity, we can ignore the difference between active returns and mean returns.

OK – Now tell me the best mutual fund

This is a simple 4-step process. Start from the main ranking page.

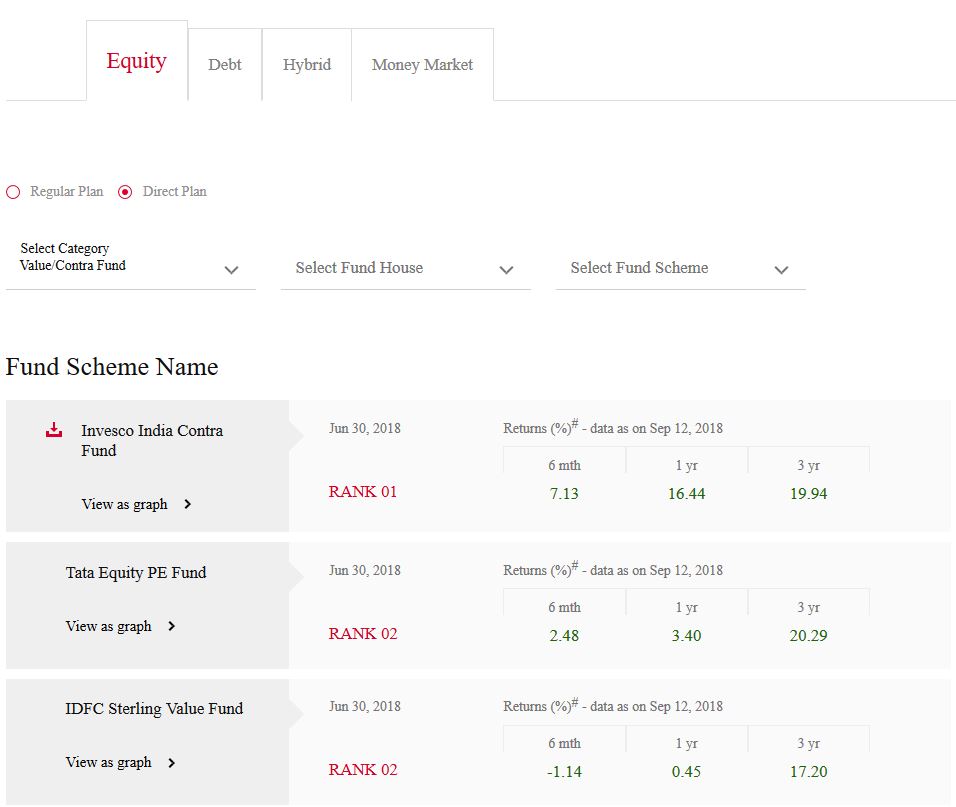

- Select the Equity category and select Direct Plan. (Since we are using 3 year data, it is better to compare direct plans.)

- Choose the category (By default the most popular category of ELSS is selected.)

- Look at the funds with Ranks 1 and 2

- Choose one or more from them. If you want just one ‘best’ fund, select the first one in the list.

A screenshot for value funds is included below for illustration.

If you look at the 1-year and 3-year returns of all the funds closely, you can see that funds with a better 1-year return, but lower 3-year return have lower ranks. You can also see that consistency is not very important in the rankings.

Conclusion

CRISIL rankings use 3 year performance data for equity funds. With this constraint, the rankings provide an ordered list of funds based on the relevant parameters. They can be used to quickly come up with a short list of better funds in any category.

Pingback: Best Mutual Funds – Selection Guide | SriNivesh Blog - Advice you can trust!