Best Mutual Funds?

‘Best Mutual Fund’ is one of the most common question/search term in personal finance. There are tons of sites that offer a list of Best Mutual Funds, Best Largecap Funds, Best Liquid Funds, etc. Most, but not all, of these sites also list the parameters that they have used to come up with their selection. In this post we would look at some parameters that can be used to shortlist ‘better’ equity mutual funds. Later articles would provide step-by-step guide to make the selection.

First Things First

-

The financial goal that you have

-

Time available to build the corpus

-

Your expected return

-

Your tolerance to volatility

-

Your ability to stay invested and stay focused

-

and more…

Evaluating Mutual Funds

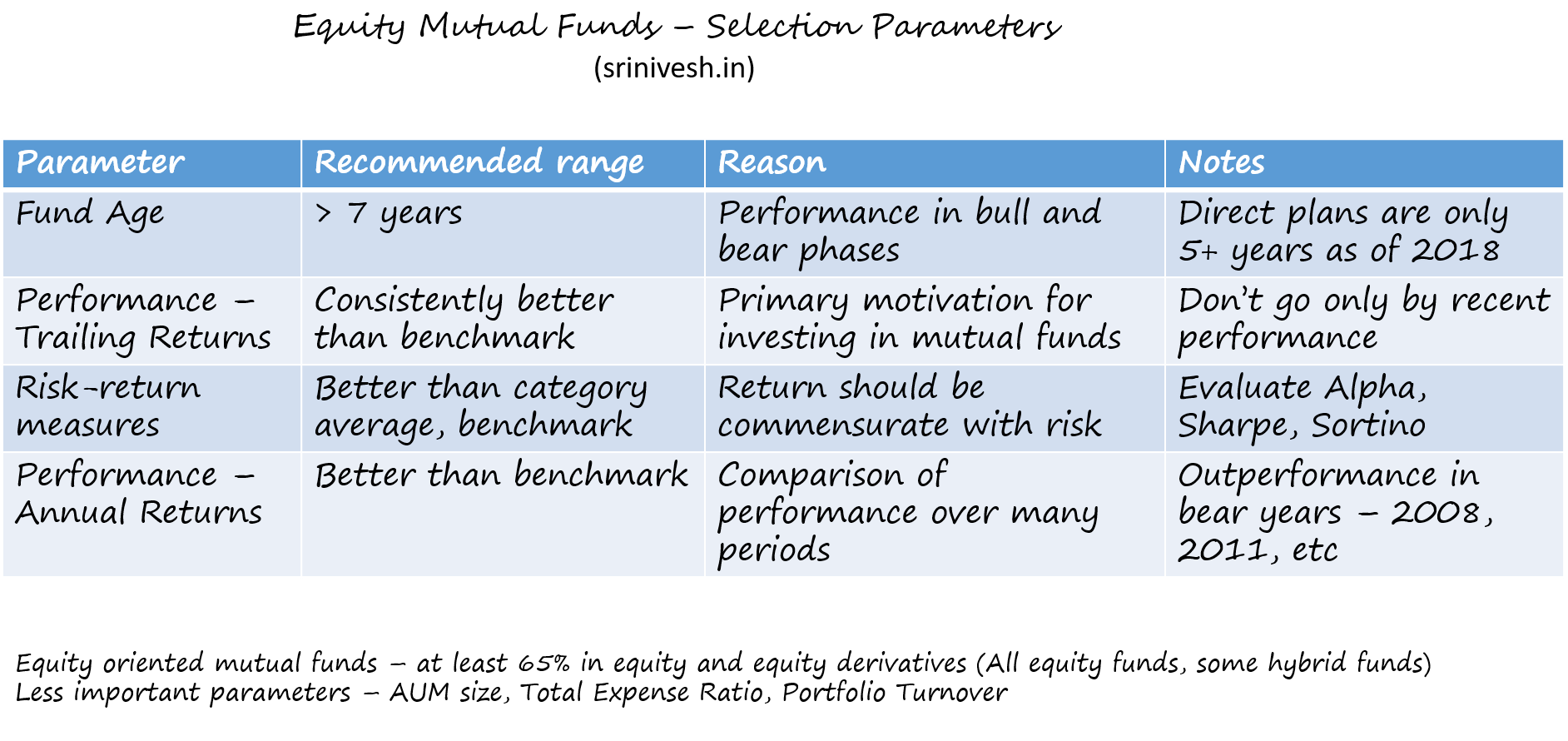

Let us assume that you have done the first things and have picked one category of mutual funds as appropriate to invest in. You can then use these parameters to arrive at a list of ‘best funds’ in that category:

-

Fund Age

-

Trailing Returns

-

Risk-Return measures

-

Annual Returns

-

Minor factors – AUM size, Expense Ratio, Portfolio Turnover

Why these parameters, and not others?

Like most lists, the list of parameters is also subjective – particularly the age of the fund. Focusing on funds with long history penalizes newer funds – some of which may have excellent processes and investment mandates. But for the popular categories like large cap, ELSS, Balanced (now Hybrid Aggressive), etc. it would be useful to start with funds that have a long track record.

Once a short list has been made, AUM size and TER can be looked at to trim the list to a handful.

Wait – What about the Star Rating?

CRISIL publishes periodic ranking of mutual funds. (See here. ) Many mutual fund analysis sites assign and publish Star Ratings. Relying on these alone, or relying on them primarily, has many pitfalls. Most of the rankings focus on a specific time period – 3 years in many cases. Invariably funds with recent good performance have better rankings. This also causes the rankings to change reasonably often. If you are focusing on funds with long track record, it would help to ignore the Rankings and Ratings.

OK – Now tell me the best mutual fund

As it so happens, the best mutual fund is an ever changing chimera. For the typical investor, it is far more helpful to use a set of parameters to short list the better funds. One can then simply pick 1 or more from this list and invest. That is all!

Pingback: Best Mutual Funds – Selection using CRISIL Rankings | SriNivesh Blog - Advice you can trust!

Pingback: Best Mutual Funds – Selection using ValueResearch | SriNivesh Blog - Advice you can trust!

Pingback: Say No to mutual fund NFO | SriNivesh - Advice you can trust!